Today In History: Federal Income Taxes Go Into Effect

Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes. -- Benjamin Franklin [Letter to John-Baptiste Le Roy, 1789]

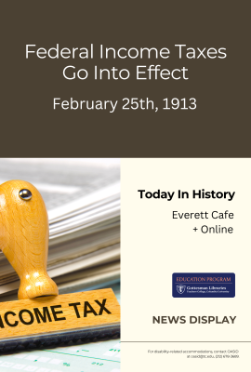

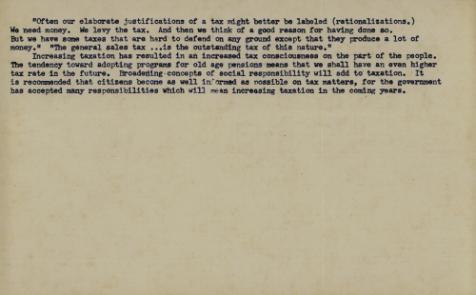

It's interesting how the Teachers College Citizenship Education Project (1949-1957) folded the study of taxes into the Social Studies Curriculum, highlighting the role of the people in the democratic process of government. And, how Founding Father Benjamin Franklin centuries earlier expressed the real unavoidability of taxes, similar to death. We feel the certainty of these concepts: the right and privilege of voice, coupled with civic responsibility -- not to mention the inevitable end of living beings. Amidst we feel the taxpayer burden that looms annually on April 15th for most filers, or mid-October for those with extensions -- all of which entails detailed paperwork for a matter that has been debated since the early twentieth century.

The first United States federal income tax was created in 1861 during the Civil War as a flat tax, but it was repealed in 1872. The United States Congress expected income taxes to be apportioned among the states according to their populations, but by 1909 the Sixteenth Amendment to the United States Constitution was introduced. On February 3rd, 1913, the Sixteenth Amendment was ratified, allowing the federal government to collect taxes as a way to better fund federal programs and services. On February 25 of that same year, the 16th Amendment became an official part of the Constitution, granting Congress constitutional authority to levy taxes on corporate and individual income.

Congress has the power to impose taxes and other levies on the general public, including those for estates, real estates, gifts, and Social Security. Income tax rates initially applied to everyone based on their incomes, regardless of their filing status -- single, married, or head of household. Over time, the filing of taxes grew more complex, as filing allowances changed over time; deductions for itemized expenses were permitted; and taxation policies changed.

The following articles are drawn from Proquest Historical Newspapers, which informs and inspires classroom teaching and learning.

- IRS Attack on Income Tax: Constitutionality of Law Is Arraigned in Brief Three Reasons Assigned to Show Act Invalid Says Arbitrary Power Vested in Secretary of Treasury Suit Brought in Detroit. (1915, Jun 27). Courier-Journal (1869-1922)

- Tax-Exempt Bonds a Growing Issue: Billions in Securities Are Now Free of Income Tax Levies Begun in 1913. (1935, Jun 30). New York Times (1923-)

- The Income Tax Evil. (1944, Feb 16). The San Francisco Examiner (1902-)

- Hamburg, A. M. (1953, Mar 10). Tax Origin Recalled: Forty-Year History of Income Tax Legislation Is Traced. New York Times (1923-)

- The Swiss Aren't Crazy. (1953, Dec 09). Chicago Daily Tribune (1923-1963)

- Willard, S. J. (1965, Mar 08). The Income Tax. The Sun (1837-)

- Federal Income Taxes Long-Debated Issue. (1975, Feb 27). The Austin American - Statesman (1973-1980)

- Income Tax Has History of Debate. (1975, Mar 15). The Hartford Courant (1923-)

- Jay, P. A. (1982, May 09). Taxes: Make it Simple. The Sun (1837-)

- DiBacco, T.V. (1987, Apr 10). A Taxing Time of Income Outgo. The Washington Post (1974-)

Tips:

- Haugen, D. M. (2014). Should the Federal Income Tax Be Eliminated? Greenhaven Press, a part of Gale Cengage Learning. e-book.

- Shepard, C. M. (2010). The Civil War Income Tax and the Republican Party, 1861-1872 (1st ed.). Algora Pub. e-book.

- Stanley, R. (1993). Dimensions of Law in the Service of Order : Origins of the Federal Income Tax, 1861-1913 (1st ed.). Oxford University Press. e-book.

Images:

- Citizenship Education Project. (1952). 14d No Tax Can Be Imposed Without the Consent of the People. Front of Card, from the Citizenship Education Project. Courtesy of Teachers College, Columbia University.

- Poster Image: Income Tax Stamp, Courtesy of Canva.

- Citizenship Education Project. (1952). 14d No Tax Can Be Imposed Without the Consent of the People. Back of Card, from the Citizenship Education Project. Courtesy of Teachers College, Columbia University.

Need to keep current, look to the past, teach a topic? The Everett Cafe features daily postings of news from around the world, and also promotes awareness of historical events from an educational context. Be sure to check additional Cafe News postings on the library blog.